Offshore Company Formation: Maximizing Growth Possible

Offshore Company Formation: Maximizing Growth Possible

Blog Article

Insider Insights on Navigating Offshore Business Development Successfully

Starting the journey of setting up an overseas firm is a critical decision that requires meticulous planning and execution. The intricacies entailed in navigating the intricacies of overseas firm development can be intimidating for also skilled business owners. Gaining insider understandings from specialists who have effectively navigated via the process can offer indispensable guidance and a competitive edge in this arena. As we look into the nuances of picking the best jurisdiction, recognizing legal needs, managing tax obligation ramifications, developing financial relationships, and making certain conformity, a wealth of expertise awaits those looking for to grasp the art of overseas business formation.

Picking the Right Jurisdiction

When considering overseas company formation, selecting the proper territory is a crucial choice that can considerably affect the success and operations of business. Each territory uses its very own set of lawful frameworks, tax obligation guidelines, privacy legislations, and financial motivations that can either prevent a business or benefit's objectives. It is important to carry out comprehensive research and look for specialist guidance to make certain the picked jurisdiction aligns with the company's needs and goals.

Elements to take into consideration when selecting a jurisdiction consist of the economic and political stability of the area, the convenience of operating, the level of monetary privacy and discretion provided, the tax obligation ramifications, and the regulative atmosphere. Some jurisdictions are recognized for their beneficial tax structures, while others focus on personal privacy and property protection. Comprehending the unique attributes of each territory is critical in making a notified choice that will sustain the lasting success of the overseas business.

Inevitably, choosing the ideal territory is a tactical relocation that can give possibilities for development, asset protection, and functional performance for the offshore company.

Recognizing Lawful Requirements

To ensure conformity and authenticity in offshore company development, a thorough understanding of the legal demands is important. Different territories have varying lawful frameworks controling the facility and procedure of overseas business. It is necessary to carry out detailed study or seek professional suggestions to grasp the particular lawful stipulations in the picked jurisdiction. Usual legal needs may include registering the company with the suitable governmental bodies, adhering to anti-money laundering guidelines, maintaining accurate monetary records, and satisfying tax obligation obligations. Additionally, recognizing the reporting demands and any required disclosures to regulative authorities is essential for ongoing conformity. Failure to follow legal needs can cause serious consequences, such as fines, fines, and even the dissolution of the overseas company. Remaining informed and up to day with the lawful landscape is vital for efficiently browsing offshore business development and making certain the lasting sustainability of the service entity.

Browsing Tax Effects

Comprehending the complex tax effects associated with offshore firm formation you can try here is critical for ensuring conformity and optimizing economic approaches. Offshore firms often offer tax obligation advantages, yet browsing the tax landscape needs complete knowledge and proper preparation.

In addition, transfer rates policies need to be very carefully evaluated to make sure deals in between the offshore entity and relevant celebrations are conducted at arm's length to avoid tax obligation evasion allegations. Some jurisdictions offer tax rewards for certain sectors or tasks, so understanding these incentives can aid make best use of tax cost savings.

Moreover, keeping up to day with progressing international tax obligation policies and compliance requirements is important to prevent charges and maintain the firm's credibility. Looking for expert recommendations from tax obligation specialists or specialists with experience in offshore tax obligation issues can supply useful insights and make certain a smooth tax obligation planning procedure for the offshore business.

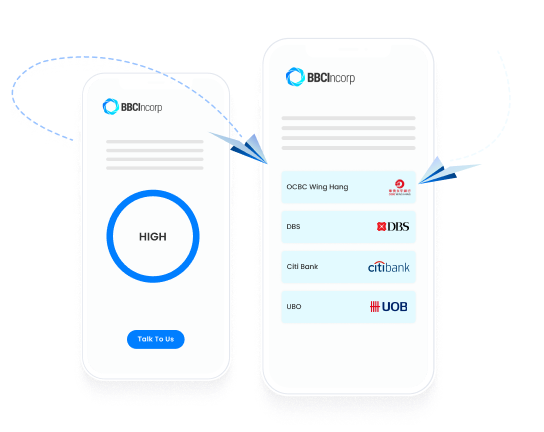

Establishing Banking Relationships

Establishing secure and dependable financial relationships is a crucial action in the procedure of overseas firm formation. offshore company formation. When establishing banking connections for an overseas business, it is vital to select respectable banks that supply solutions customized to the specific demands of international companies. Offshore firms often call for multi-currency accounts, online financial centers, and seamless worldwide purchases. Picking a bank with an international presence and proficiency in dealing with overseas accounts can enhance monetary operations and ensure compliance with global regulations.

Furthermore, before opening a savings account for an overseas firm, detailed due persistance treatments are typically required to confirm the legitimacy of business and its stakeholders. This might involve offering in-depth documentation concerning the company's tasks, resource of funds, and advantageous proprietors. Constructing a transparent and participating connection with the selected bank is essential to browsing the intricacies of overseas financial successfully.

Making Certain Compliance and Reporting

After establishing safe and secure financial connections for an offshore company, the following essential step is making sure conformity and reporting actions are diligently followed. Engaging monetary and lawful specialists with web link proficiency in overseas territories can assist navigate the intricacies of compliance and reporting.

Failing to adhere to guidelines can cause extreme penalties, penalties, or perhaps the abrogation of the offshore business's permit. Remaining attentive and positive in making certain conformity and coverage needs is critical for the long-term success of an offshore entity.

Final Thought

To conclude, successfully browsing offshore company formation needs mindful consideration of the territory, legal demands, tax implications, financial partnerships, conformity, and reporting. By understanding these vital variables and ensuring adherence to regulations, businesses visit this site right here can develop a strong structure for their offshore procedures. It is critical to look for professional assistance and expertise to browse the intricacies of overseas company formation properly.

As we dive right into the subtleties of picking the best territory, comprehending legal needs, taking care of tax obligation implications, establishing financial connections, and making sure conformity, a wide range of understanding waits for those looking for to master the art of overseas business formation.

When taking into consideration overseas company formation, selecting the proper territory is a crucial choice that can substantially impact the success and procedures of the company.Understanding the elaborate tax implications associated with offshore business development is vital for making certain compliance and maximizing financial methods. Offshore firms commonly offer tax advantages, but browsing the tax obligation landscape calls for complete understanding and correct planning.In verdict, successfully navigating offshore company formation calls for careful factor to consider of the jurisdiction, legal demands, tax obligation ramifications, financial partnerships, compliance, and reporting.

Report this page